PMC Unpaved

IRA-QCD

Make a tax-free gift to PMC Unpaved directly from your IRA as a Qualified Charitable Distribution.

- You must be age 70 1/2 or older

- $108,000 maximum annual donation

- Download a sample letter to your IRA administrator to request a charitable gift transfer to PMC Unpaved.

- When requesting a Qualified Charitable Distribution (QDC), reference the Pan-Mass Challenge's tax ID 04-2746912. PMC Unpaved is a spoke in the wheel of the Pan-Mass Challenge.

They also qualify for your Required Minimum Distribution (RMD). RMDs must be taken each year beginning with the year you turn age 72 if you turn 70 ½ in 2020 or later (70 ½ if you turned 70 ½ in 2019 or earlier).

Contact PMC Fundraising Associate Jessica Otto Guay for more information about IRA donations.

#1

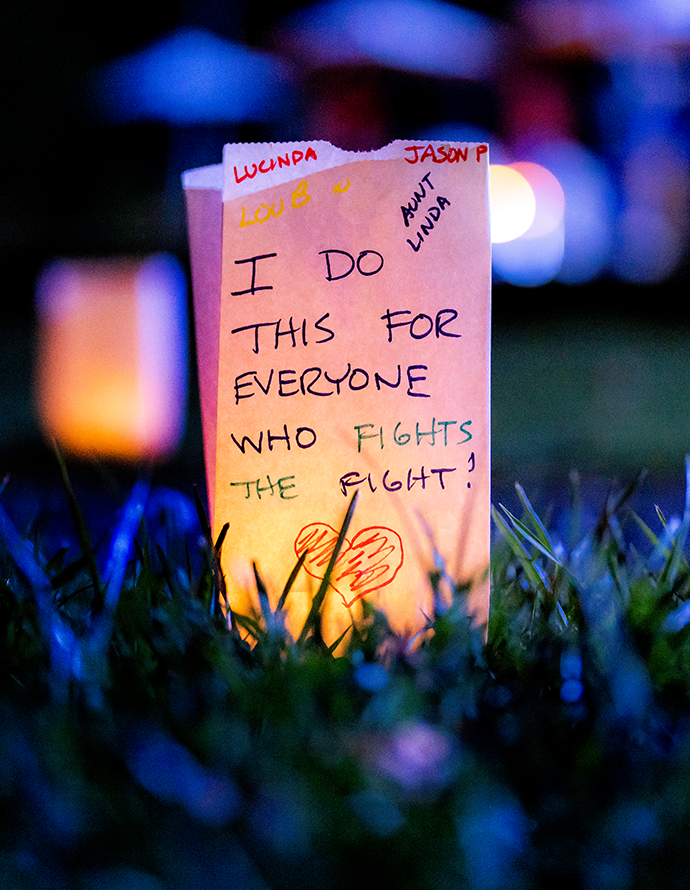

The inaugural PMC Unpaved was October 1, 2022

100%

Every rider-raised dollar goes directly to cancer research and treatment at Dana-Farber and the Jimmy Fund

$1.125 billion

Raised by the PMC for Dana-Farber Cancer Institute since 1980

/documents-resource.jpg?width=600&height=400&name=documents-resource.jpg)